How Can Mindfulness Give You a More Abundant Retirement?

Are you ready to let go of anxiety and find the peace of mind you seek as you prepare for your golden years?

Early-Career | Mid-Career | Late-Career

Your Answer Lies in These 5 Critical Retirement Questions:

Am I on track for financial independence?What do I need to do to get on track?

How do I design a mindful investing portfolio?

How do I manage that portfolio and my income over time through changing markets?

How do I prepare non-financially for retirement? What are the dominant variables in a happy retirement?

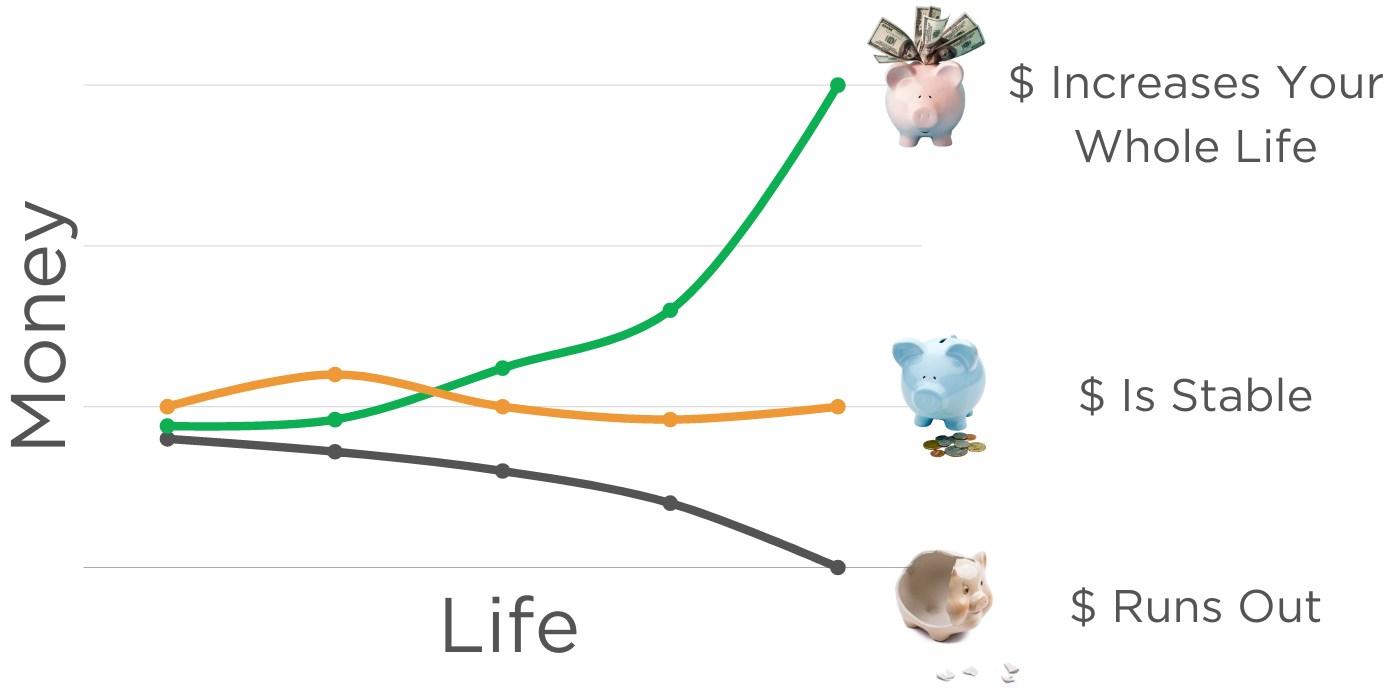

Which Scenario Best Predicts Your Future?

This 5-Session Virtual Workshop Will Help You Answer:

SESSION #1: Am I on track for financial independence? What do I need to do to get on track?

SESSION #2: How do I design a mindful investing portfolio?

SESSION #3: How do I manage that portfolio and my income over time through changing markets?

SESSION #4: How do I prepare non-financially for retirement? What are the dominant variables in a happy retirement?

SESSION #5: Ask Me Anything! (Q&A Discussion)

Meet Your Instructor

Jonathan K. DeYoe is the bestselling author of Mindful Money: Simple Practices for Reaching Your Financial Goals and Increasing Your Happiness Dividend and has led a Bay Area wealth management office focused on client education for over 2 decades. As a Lutheran seminarian turned Buddhist academic turned financial advisor, Jonathan is always bridging money and life. He believes that anyone can experience a vibrant, financially successful life by developing a few important beliefs and following a few simple practices. He does his best work teaching these beliefs and practices in spaces where love and money overlap.

How Do I Know If This Workshop Is Right For Me?

Who Should Attend? Who Shouldn't?

Mindful Retirement Review Workshop is for anyone interested in Financial Independence. It is for everyone that wants to retire comfortably and stay comfortably retired.

How each of us defines “retirement” will be different, but we will all retire someday. Some of us will voluntarily (and happily) leave the workforce and seek some serious R&R, and some of us will have to be dragged out of the office. Others will seek to continue "working" in a different capacity – whether there's an attached income stream or not.

The Mindful Retirement Review Workshop considers each of these possibilities.

Whether you're just beginning your working/earning/saving/investing journey, whether you're at the tail end of a lifetime of saving and investing, or whether you're somewhere in the middle, the Mindful Retirement Review Workshop can show you the path to a retirement income you can’t outlive, clarify the trade-offs you have to make, and give you the confidence that you will, eventually, get there.

Most importantly, this workshop is for anyone who wants to simplify their investing life – make fewer decisions while increasing the probability of good outcomes.

There are never any guarantees, but if we focus on making the right trade-offs, we can increase our chances without spending unnecessary time and energy in the process.

There are NO MINIMUMS for attendance. If you are just starting out, The Mindful Retirement Review Workshop will set you on a real path to creating a passive income you cannot outlive. If you do not have a retirement income plan, or are simply unsure of your retirement income, the Mindful Retirement Review Workshop is perfect for you.

What Would It Cost to Get This Advice Ordinarily? Is It Worth the Money?

The Mindful Retirement Review Workshop costs $1600 if you register before March 31, or $2000 if you register at full-price after April 1. Attendance is capped to ensure every attendee leaves with a Retirement Review.

I have been a "Retirement Income Planner" for my entire 25-year career. I have done the retirement income math in this workshop for over 1000 client families. I have been with over 400 families as the primary breadwinner successfully transitioned from "working and saving" to "retired and drawing from their portfolios for income."

For my entire career, even before I had a penny myself, I worked with families who had millions of dollars. Before the launch of this program, ALL of our clients paid a "% for assets" fee. My average client has $2.5 million and pays just under 1% for a fee of roughly $24,000 a year to be their "family CFO." Yes, these are seamless pro-active services that cover a lot more than just Retirement Income Planning. But "Retirement Income" is the dominant question ALL clients have in common.

If you take the lessons of this Mindful Retirement Review Workshop to heart and apply them on your own, you will be saving 10's or 100's of thousands of dollars. And, if you ever need a refresher, you can download the workbook again or come back to this workshop.

Even if you meet the $500,000 minimums for seamless, pro-active advice, you may want to consider the workshop. By choosing this route rather than hiring an advisor, your savings potential that first year would be at least $3000. If you had to come back to revisit the math and update your plan every other year, then your savings over a decade would approach $40,000.

(If you do need more support, you can become a Mindful Money Member and get additional group coaching for $200/month. Mindful Money Membership is also capped – to make sure everyone has a chance to get their questions answered.)

A word from Jonathan's former students...

"Jonathan's workshop was a practical, engaging and valuable event for the students, faculty and staff of the Graduate Theological Union. His style conveyed with clarity and humor important life information that is, to many, a dull topic. We especially appreciated his thoughtfulness on the importance of integrating personal values with financial goals."

-E.A.

"The financial noise is deafening. Investment companies advertise performance (while disclosing past performance is no guarantee...). Advisors say planning is critical. Fin-tech says to always reduce costs. I don't know who to believe, much less how to make good financial choices. In the Mindful Money program, Jonathan busted up some financial mythology; bridged money and happiness; and gave me a simple framework to improve my money choices."

-J.J.

"Every advisor ends up sounding the same as they talk about planning and investing. Jonathan transforms the client-advisor relationship by helping clients focus on their unique brand of happiness. The reality is that no one can promise better money outcomes. By creating an eco-system to enhance client happiness, Jonathan improves both financial and life outcomes."

-G.O.

"Jonathan teaches you both the why and the how of wealth.... If you read one money book this year, let it be Mindful Money; if you attend one retirement planning seminar, let it be Mindful Money's retirement workshop."

-B.F.

"If there were a simpler and smarter way to manage your money and your life, you'd want to know, right? Sign up today."

R.S.

"Mindful Money is concerned with how our money conversations fit into the bigger goal of a satisfying life. Jonathan makes you ask yourself, 'how much money do I really need to be happy?' Once you've decided where you're going, he will help you create the plan to get there."

J.L.

Jonathan K. DeYoe is the founder of Mindful Money. The opinions voiced and all accompanying materials are for general information only and are not intended to provide specific advice to any individual. Past performance is no guarantee of future results. All indices are unmanaged and cannot be invested in directly. Investing involves risks including possible loss of principal. There can be no assurance that any technique or strategy discussed on Mindful Money will be suitable for any particular investor and there is no guarantee of any specific outcome. Mindful Money renders no individual advice. Personal Financial Planning and Investment Advice are offered only to clients who have signed an advisory agreement with EP Wealth, a registered investment advisor. If you have the minimum investment of $500,000 and are seeking individual advice, please visit https://mindful.money/contact-us and we will connect you with a qualified advisor at EP Wealth.